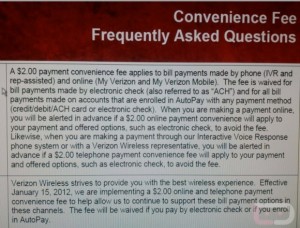

There is no such thing as a free lunch. Apparently there is also no such thing as hard-working, honest Americans paying their monthly phone bill without being charged for the privilege. Starting January 15, 2012 Verizon Wireless is going to charge their customers $2 per month for anyone that pays their phone bill online or via the phone. (This is $2 per bill — not $2 per line, for those that have family plans.) The only way to avoid this $2 surcharge is to either signup for Autopay or pay via electronic check.

There is no such thing as a free lunch. Apparently there is also no such thing as hard-working, honest Americans paying their monthly phone bill without being charged for the privilege. Starting January 15, 2012 Verizon Wireless is going to charge their customers $2 per month for anyone that pays their phone bill online or via the phone. (This is $2 per bill — not $2 per line, for those that have family plans.) The only way to avoid this $2 surcharge is to either signup for Autopay or pay via electronic check.

For what it is worth, Verizon Wireless isn’t the only one doing this. Sprint and T-Mobile USA have already done something similar; last year Sprint started charging customers $4.99 unless they signed up for automatic payments and T-Mobile started charging customers $1 per month for receiving a paper bill, so Verizon is sort of late to the party. Still, though — getting charged for paying your damn bill? Forget net neutrality; how about dont-charge-customers-for-paying-their-bills neutrality, first.

As a conciliation prize, this new fee most likely will trigger that sweet clause in your contract with Verizon that states you can break contract and stop using Verizon Wireless services without paying an Early Termination Fee if Verizon changes the terms of the contract. Tacking on an extra fee may or may not be considered a change in the terms of contract — only time will tell. Be sure to let us know if you are able to quit Verizon without paying ETF because of this.

Feel free to discuss in the comments below.

[via Engadget]

Email article

Email article